Your Perfect Solution for AI-Driven Lead Generation, Follow-Up, and Database Management

Find out why top-performing teams, brokerages, and agents use Ylopo as their digital marketing powerhouse.

Find out why top-performing teams, brokerages, and agents use Ylopo as their digital marketing powerhouse.

Ylopo is the leader in developing A.I. for real estate agents. rAIya (AI Texting) began 5 years ago and now A.I. is infused into every part of the Ylopo suite to maximize performance and efficiency.

Higher quality, lower cost. Discover our omnichannel approach to lead generation.

High engagement, automated outreach with email, remarketing, display, and video campaigns.

Autonomous A.I. text and calling solution that turns leads into live transfers and appointments.

Kyle Whissel

Team Leader

Whissel Realty Group, Brokered by eXp Realty

Jason O'Keefe

CEO/Realtor

Real Home Experts in Burlington, Ontario

New Leads Generated

7 texts, 7 calls first 10 days

35+ text and Call Attempts in 90 days

Priority signal drive 6+ text & Voice per month

Database activity driven text and voice

Best seller lead generation & nurture platform for real estate agents & teams.

Go Beyond Home Valuation Ads. Ylopo Uses Powerful MLS Data & Custom Seller Reports + Cash Offers to Generate High-Engagement Leads. Get a consistent flow of high quality seller leads you can start talking to right now.

Educated Sellers, Engaged Leads: Ylopo's NEW Seller Report Help Sellers Understand Their Options While Triggering Hot Leads for You.

In your listing presentations you’ll be able to show sellers real data that separates you from the competition. You can show buyers already in your database that are looking for a home just like their.

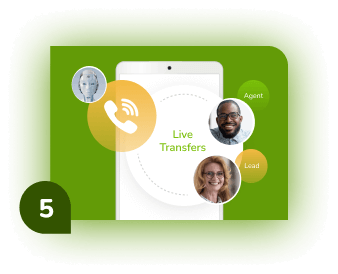

rAIya Voice autonomously makes phone calls that a full-time agent would. From lead nurturing to scheduling, it handles it all–without any training, managing, or motivating.

rAIya Text sends messages to your leads based on signals sent from other parts of the Ylopo system. Trained over millions of real estate text conversations and now enhanced with the profound dynamic ability of ChatGPT, this AI chatbot does one thing: fills your calendar with qualified appointments.

Consumer opens Listing alert

Favorites a listing on your website

A.I. texts the consumer to see the property

Consumer replies "yes" A.I. calls to set the appointment

Immediately live transfers the lead to an agent

Ylopo’s Dynamic Lead Registration process asks engaging questions and gets the lead invested in the experience so they want you to contact them to talk more about their real estate journey.

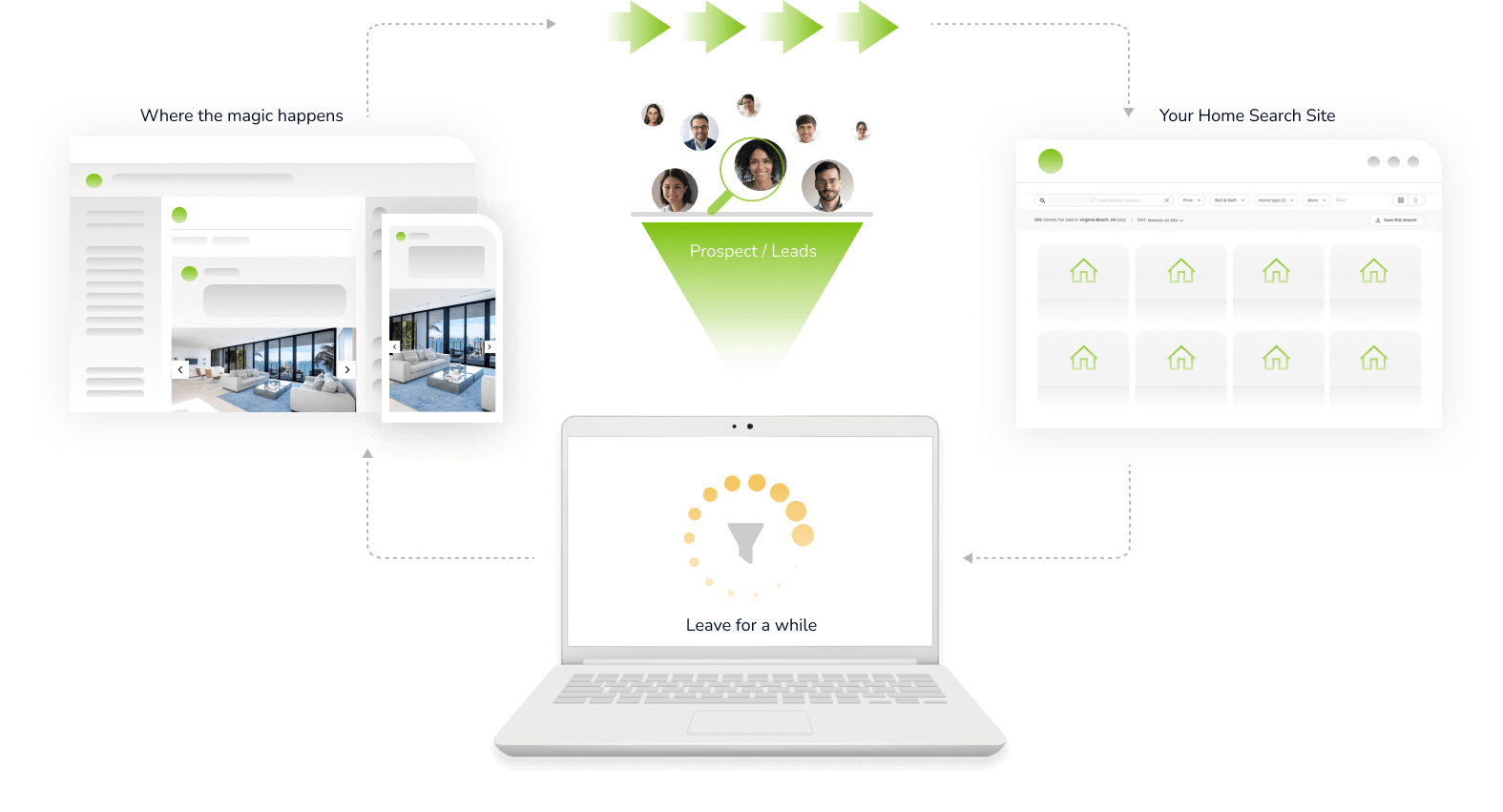

Ylopo’s dynamic remarketing technology targets your dead leads on social media platforms to serve fresh listings similar to the ones they were most interested in which turns 25% or more of them into new opportunities.

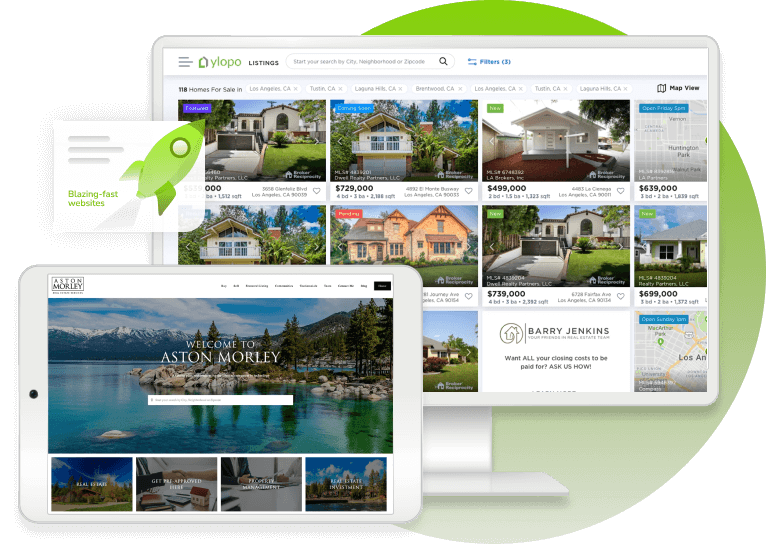

Turnkey or unlimited flexibility—the choice is yours. Every Ylopo client gets a custom-branded website with home search functionality that rivals the portals.

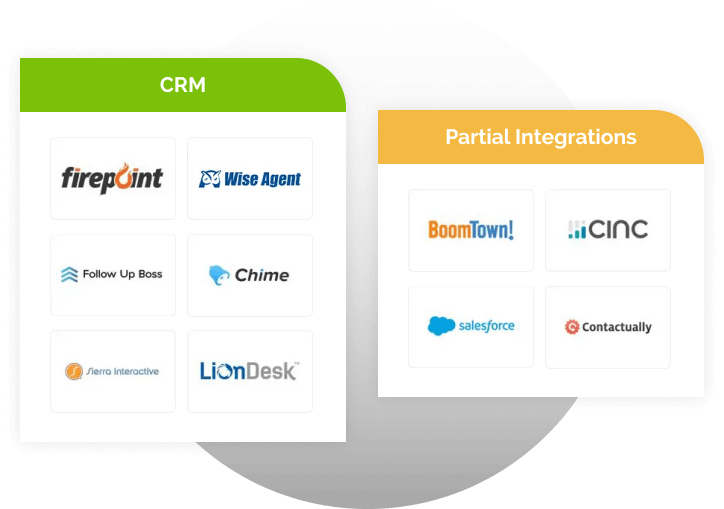

Ylopo integrates with dozens of CRMs and applications to ensure you leverage the best solution for your needs.

We do everything, but you can take control at any time. Ylopo’s Mission Control dashboard gives clients full transparency on where your budgets are being spent and the ability to adjust campaigns at the click of a button.

Google Business Profile (GBP) and Local Services Ads (LSA) generate the highest quality online leads available. Ylopo helps you capture more 5-star reviews, optimize your profile for search, and get approved by Google to be a part of LSA in your area. Past that, we call Google on your behalf to get refunds on garbage leads that otherwise would have cost you.

Strategies for Real Estate Agents and Teams